La version française suit

City Council will be making a decision on Friday, November 7 on the future of Lansdowne Park. At committee last week, we heard from nearly 90 delegations, we asked questions to city staff, and we debated the pros and cons of the plan in front of us. This post is the second of two parts. Be sure to read Part 1 first: “How we got here”.

Part 2: Balancing risk and opportunity

City staff have recommended a final construction plan and financial strategy outlining the cost and revenues of Lansdowne 2.0. You can access the staff report and documentation here. When I reference pages in the report, I’m referencing document 3.4: “Report – Lansdowne 2.0 2025 Report_oct22 AODA.pdf”.

There has been a lot of noise over the past two weeks on this file, from both sides. Count me somewhere in the middle: I’ve supported a redevelopment of Lansdowne, with a great deal of caution pending the final numbers and analysis. When I read the report, listen to delegations, and challenge staff, I’m trying to separate signal from the noise. Mainly, what is the level of risk attached to various aspects of the plan? How are the risks being mitigated? What are the benefits of moving forward? How does this all balance out?

Capital project funding sources

The new arena arena and north side stands will cost $419-million to build, funded via four main funding sources.

🏙️ Air rights is a fee paid by a developer for the right to build housing (apartments, condos, hotel) on top of the north side stands. A builder called Mirabelle won a competitive process with a bid of $65-million. After accounting for City construction costs and a contribution to affordable housing, the net amount to offset construction is $33.9-million. There is a low level of risk associated with this funding source.

🏦 Internal funding includes $48-million funding from capital reserves and bond premium revenue. There is no risk with this funding source.

🏨 Municipal accommodation tax is from a city-wide tax assessed on hotel and short-term rental stays. Since Lansdowne Park events attract a significant number of out-of-town visitors, $6-million of this tax is being allocated to Lansdowne construction. There is no risk with this funding source.

✅ Those sources total $88-million, leaving $331-million left funded through debt – essentially a long-term mortgage.

(The debt amount could be further reduced by $20-million if a provincial tourism grant is approved, but they’re not including it in the calculations for now.)

Long term debt

- The City would take out a loan for $331-million, with debt payments from 2031 to 2070.

- Total yearly debt payments based on a 4.25% interest rate are $17.4-million. (Net present value.)

- Offsetting revenue of $13.0-million would lower yearly debt costs to $4.3-million. (The left over $0.1-million is due to rounding.)

The revenue to offset the debt payments comes from several sources including:

💵 Additional property tax revenue ($3.6-million per year)

💵 Municipal Accommodation Tax revenue ($2.0-million per year)

💵 Ticket surcharge ($0.7-million per year)

💵 Rent ($0.5-million per year)

💵 “Return on City Equity from Waterfall” – revenue from events, sports, and retail ($6.2-million per year)

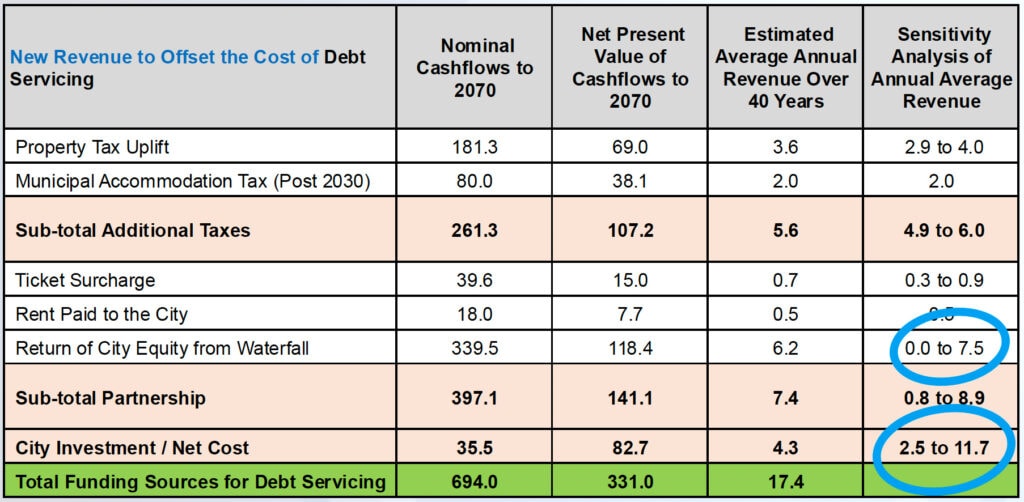

City staff developed projections of new revenue to offset the cost of debt, and Ernst & Young did a sensitivity analysis to assess the risk of each source of revenue. (Table 11, Page 119.)

✅ In a best case scenario, offsetting revenue would cover all but $2.5-million of the yearly debt payments.

❌ In a worst case scenario, offsetting revenue would cover all but $11.7-million of the yearly debt payments.

My reading of this chart is that with the exception of “Return of City Equity from Waterfall”, the sources of revenue are relatively low risk. The projected revenue from retail, sports, and entertainment operations have a lot more variability. City staff and the third party have an analysis of those revenue projections in Table 9 (page 110) of the report.

How realistic are those scenarios? To me, the retail and entertainment side of the business should be stable (or grow) in the coming decades. The sports side is more unpredictable. We’re on solid footing with major tournaments: recent events have included national and international championships for figure skating, curling, basketball, soccer and hockey. The new facilities will be even more attractive for major competitions.

But league sports tend to have ups-and-downs. Current teams include the REDBLACKS, 67’s, Charge, BlackJacks, Atlético, and Rapid FC. Four out of six are new teams since 2015. The REDBLACKS and 67’s are guaranteeing that they’ll play in Ottawa until at least 2042 and intend to stay well beyond that. Over the next 40 years it’s likely that we’ll see that mix of teams change. If recent years are any indication, interest in league sports also continues to grow so, over the long term, these revenues should be stable as well.

🏒⚡️A note on the Ottawa Charge

What we heard from the PWHL last week is that they would prefer a much larger arena to remain viable at Lansdowne Park in the long term. But a larger arena would add $80- to $100-million to the cost, and the PWHL would only guarantee staying at Lansdowne to 2031. As important as they have become in Ottawa’s sports team, I find it really hard to justify a massive change to our long-term financial plan based on the needs of one team. The PWHL and OSEG are still negotiating the long-term lease and it does sound like there are some other options in play that would help keep the team viable at Lansdowne over a longer term. More to come.

📈 On the opportunity side

A Deloitte report measured the economic benefits of Lansdowne 2.0, including:

⬆️ Increase Ottawa’s Gross Domestic Product (GDP) by $590-million over 10 years (2026 – 2035)

⬆️ Increase Ottawa’s GDP by $89-million per year annually from operations

⬆️ 4,900 new jobs created during construction

⬆️ 427 net new jobs during operations (hospitality, retail, and event management)

⬆️ Tourist spending increases by $8-million annually, with 22% higher ticketed event attendance

👍 Summing up

Is it wise to commit to an estimated yearly cost of $4.3-million for a revitalized Lansdowne? As a point of comparison, back in 2010, before the partnership with OSEG, it was costing the City of Ottawa about $4.9-million annually to operate and maintain the “old” Lansdowne. Adjusting for inflation, that’s close to $7-million in today’s dollars. So, a proposed yearly cost of $4.3-million for such a large civic facility is reasonable.

My conclusion is that the overall business case is sound and based on reasonable assumptions. My expectation is not that the project be 100% “revenue neutral”, but the revenues should offset the cost as much as possible. There is risk (there is always risk with major projects!) but staff have presented this risk transparently and realistically. Even in the worst-case scenarios, the project remains affordable and will not hinder the City from investing and maintaining other facilities.

And most of all, there is significant benefit and opportunity. The Lansdowne 2.0 facilities will give us a place to be proud of, and a chance to put our best foot forward for national and international visitors, touring musicians, and sports organizations. That’s a big step up from what we’re presenting to the world at Lansdowne 1.0 today.

What’s next: The Auditor General presents her analysis on the financial plan on Tuesday, followed by the City Council vote on Friday. I anticipate we’ll see a few tweaks and adjustments before the end of the week.

UPDATES:

Auditor General (November 4)

- The Auditor General published her report on Lansdowne and presented it at committee on Tuesday. The AG pointed out that she is not making a recommendation on whether or not Council should go ahead, but rather she is highlighting areas of risk that council needs to consider. Does the risk fall within our risk appetite? And do the benefits of the project justify any risk that we may be taking on. She also made three recommendations to City staff that have been accepted.

City Council (November 7)

City Council approved the project 15-10 with a number of amendments, including:

- Councillor Gower: Directed staff to present options to improve governand oversight of the project.

- Councillor Menard: Increase the affordable housing contribution by $5-million, for a total of $19.4-million

- Councillor Dudas: Review and enhance OC Transpo and other transportation options

- Councillor Skalski: Continue negotiations with the Ottawa Charge

- Councillor Plante: Offset the loss of 1 acre of green space at Lansdowne with another acre of park space in Capital War

CARNET DE NOTES : Le Conseil municipal s’apprête à voter sur le projet Lansdowne 2.0 (partie 2)

Le Conseil municipal se prononcera le vendredi 7 novembre sur l’avenir du parc Lansdowne. La semaine dernière, les membres du Comité ont entendu près de 90 personnes, posé des questions au personnel de la Ville et discuté des avantages et des inconvénients du plan qui leur a été présenté. Ce message est le dernier de deux. Lisez d’abord la partie 1 ici : Démarche

Partie 2 : Équilibrer les risques et les retombées

Le personnel de la Ville a recommandé un plan de construction final et une stratégie financière énonçant les coûts et les recettes du projet Lansdowne 2.0. Vous pouvez consulter le rapport du personnel et la documentation ici. Lorsque je cite des pages du rapport, je fais référence au document Report – Lansdowne 2.0 2025 Report_oct22 AODA.pdf.

Ce dossier a beaucoup fait parler de lui dans les deux dernières semaines, des deux côtés. Je me situe quelque part au milieu : j’appuie le réaménagement du parc Lansdowne, mais je fais preuve d’une grande prudence en attendant les analyses et résultats finaux. Quand je lis un rapport, j’écoute les interventions et je discute avec le personnel, j’essaie de faire la part des choses. En particulier, quel est le niveau de risque associé aux divers aspects du plan? Comment les risques sont-ils atténués? Quels sont les avantages d’aller de l’avant? Comment tout cela s’équilibre-t-il?

Sources de financement des projets d’immobilisations

La construction du nouvel aréna et des gradins du côté nord coûtera 419 millions de dollars, provenant de quatre grandes sources de financement.

🏙️ Les droits de propriété aériens sont les frais payés par un promoteur pour avoir le droit de bâtir des logements (appartements, condos, hôtel) au-dessus des gradins du côté nord. Le promoteur Mirabelle a remporté le processus concurrentiel avec une offre de 65 millions de dollars. En tenant compte des coûts de construction de la Ville et de l’apport au logement abordable, le montant net pour compenser les coûts de construction s’élève à 33,9 millions de dollars. Le niveau de risque associé à cette source de financement est faible.

🏦 Le financement interne comprend un montant de 48 millions de dollars provenant des réserves infrastructurelles et du revenu des primes d’obligations. Il n’y a aucun risque associé à cette source de financement.

🏨 La taxe municipale sur l’hébergement est une taxe municipale sur les chambres d’hôtel et les locations court terme. Comme les événements au parc Lansdowne attirent un grand nombre de visiteurs de l’extérieur, 6 millions de dollars provenant de cette taxe seront affectés au projet Lansdowne. Il n’y a aucun risque associé à cette source de financement.

✅ Ces sources totalisent 88 millions de dollars; le montant de 331 millions de dollars restant sera financé par emprunt – en gros, un prêt hypothécaire à long terme.

(Cet emprunt pourrait être réduit de 20 millions si une subvention provinciale pour le tourisme est approuvée, mais nous n’incluons pas ce montant dans les calculs pour le moment.)

Dettes à long terme

- La Ville demanderait un prêt de 331 millions de dollars, avec un remboursement de la dette s’échelonnant de 2031 à 2070.

- Le remboursement annuel total de la dette, basé sur un taux d’intérêt de 4,25 %, est de 17,4 millions de dollars (valeur actuelle nette).

- Des recettes compensatoires de 13 millions de dollars porteraient la dette à 4,3 millions de dollars. (Le 0,1 million restant est dû à un arrondissement.)

Les recettes servant à compenser le remboursement de la dette proviennent de différentes sources :

💵 Recettes supplémentaires tirées des taxes foncières (3,6 millions par année)

💵 Recettes provenant de la taxe municipale sur l’hébergement (2 millions par année)

💵 Suppléments sur le prix des billets (0,7 million par année)

💵 Loyer (0,5 million par année)

💵 « Rendement des capitaux propres de la Ville dans la structure en cascade » – recettes provenant des activités sportives, de divertissement et de vente au détail (6,2 millions par année)

Le personnel de la Ville a fait des projections de nouvelles recettes pour compenser le coût de l’emprunt, et Ernst & Young a réalisé une analyse de sensibilité pour évaluer le risque associé à chaque source de recettes (tableau 11, page 119).

✅ Dans le scénario le plus optimiste, le remboursement annuel de la dette s’élèverait à 2,5 millions de dollars après les recettes compensatoires.

❌ Dans le scénario le plus pessimiste, le remboursement annuel de la dette s’élèverait à 11,7 millions de dollars après les recettes compensatoires.

J’en déduis qu’à l’exception du « rendement des capitaux propres de la Ville dans la structure en cascade », les sources de recettes comportent des risques relativement faibles. Les recettes projetées provenant des activités sportives, de divertissement et de vente au détail varient beaucoup plus. Le personnel de la Ville et le tiers ont réalisé une analyse de ces recettes projetées (tableau 9, page 110 du rapport).

Alors, à quel point ces scénarios sont-ils réalistes? Selon moi, les volets de la vente au détail et du divertissement devraient être stables (ou croître) dans les décennies à venir. Le volet sportif est plus imprévisible. Nous avons des bases solides en ce qui a trait aux compétitions d’envergure, ayant récemment accueilli des championnats nationaux et internationaux de patinage artistique, de curling, de basketball, de soccer et de hockey. Les nouvelles installations seront encore plus attrayantes pour ce type de compétitions.

Mais les sports de ligues connaissent souvent des hauts et des bas. Les équipes actuelles comprennent le ROUGE et NOIR, les 67, la Charge, les BlackJacks, l’Atlético et le CF Rapide. Quatre de ces six équipes sont nouvelles (2015 ou plus récentes). Le ROUGE et NOIR et les 67 demeureront à Ottawa jusqu’en 2042, au minimum, et comptent rester bien après cela. Dans les 40 prochaines années, ces équipes seront probablement appelées à changer. Si l’on se fie aux dernières années, l’intérêt pour les sports de ligues devrait continuer de croître, donc les recettes qui en sont tirées devraient aussi rester stables à long terme.

🏒⚡️ Note sur la Charge d’Ottawa

La semaine dernière, la LPHF a indiqué qu’un plus gros aréna serait nécessaire pour qu’il soit viable pour l’équipe de rester au parc Lansdowne à long terme. Or, un plus gros aréna coûterait de 80 à 100 millions de dollars de plus, et la LPHF peut seulement garantir qu’elle resterait au parc Lansdowne jusqu’en 2031. Si l’équipe occupe maintenant une place importante parmi les équipes sportives d’Ottawa, les besoins d’une seule équipe justifient difficilement un changement aussi important à notre plan financier à long terme. La LPHF et l’OSEG négocient encore le bail à long terme, et il semble y avoir d’autres options possibles pour assurer la viabilité à long terme de l’équipe à Lansdowne. D’autres renseignements suivront.

📈 Les retombées

Un rapport de Deloitte a mesuré les retombées économiques du projet Lansdowne 2.0, notamment :

⬆️ une augmentation du produit intérieur brut (PIB) d’Ottawa de 590 millions de dollars sur 10 ans (2026 à 2035);

⬆️ une augmentation annuelle du PIB de 89 millions de dollars grâce aux activités;

⬆️ la création de 4 900 emplois pendant les travaux;

⬆️ la création nette de 427 emplois grâce aux activités (accueil, vente au détail et gestion d’événements);

⬆️ une augmentation annuelle des dépenses des touristes de 8 millions de dollars, avec une hausse de 22 % du nombre de visiteurs payants.

👍 En résumé

Est-il raisonnable d’engager des coûts annuels estimés de 4,3 millions de dollars pour revitaliser le parc Lansdowne? En guise de comparaison, en 2010, avant le partenariat avec l’OSEG, la Ville d’Ottawa payait environ 4,9 millions de dollars par année pour gérer et entretenir le « vieux » parc Lansdowne. Avec l’inflation, c’est près de 7 millions de dollars par année. Un coût proposé de 4,3 millions de dollars est donc raisonnable pour une infrastructure municipale aussi importante.

J’en conclus que le dossier de décision est solide et basé sur des hypothèses vraisemblables. Je ne m’attends pas à ce que le projet soit totalement « neutre du point de vue des recettes », mais les recettes devraient le plus possible compenser les coûts. Il existe des risques (il y en a toujours avec les grands projets), mais le personnel a présenté ces risques de manière transparente et réaliste. Même dans les scénarios les plus pessimistes, le projet reste abordable et n’empêchera pas la Ville d’investir dans d’autres infrastructures ni de les entretenir.

Et surtout, il y a des retombées et des avantages importants. Le projet Lansdowne 2.0 nous permettra d’avoir un endroit dont nous sommes fiers et nous donnera la chance de faire bonne impression devant les visiteurs d’ailleurs au Canada et de l’étranger, les artistes en tournée et les organismes sportifs. Ce sera une nette amélioration par rapport à ce que nous montrons au monde à Lansdowne 1.0 aujourd’hui.

Prochaines étapes : La vérificatrice générale présentera son analyse du plan financier mardi, qui sera suivi du vote du Conseil municipal vendredi. Je crois que nous verrons quelques mises au point et ajustements d’ici la fin de la semaine.